Going through an IRS Audit can be a big deal if you’re not prepared. But with today’s technology, we’re going to show you an easy way to make sure you have all the documentation you need to prove your business expenses. I’m not saying that all audits are the same, but most of the ones we’ve helped clients through ask for substantiation, or proof, of certain expenses that you’re claiming on your tax return. If you can’t provide adequate records and prove the business purpose, then the IRS could disallow those expenses—and you don’t want that!

Use Technology

We spend lots of time vetting out new technologies to find the ones that work well, and the ones that don’t. Part of this process is actually using the apps, and analyzing a few things: 1. How easy is it to use and 2. Does it work well with a general small business work process? Our favorite app for retaining information is Evernote. If you’ve never heard of Evernote (that would be surprising), we recommend checking them out on the web. We’re going to show how to use Evernote to audit-proof your business.

Introduction to Evernote

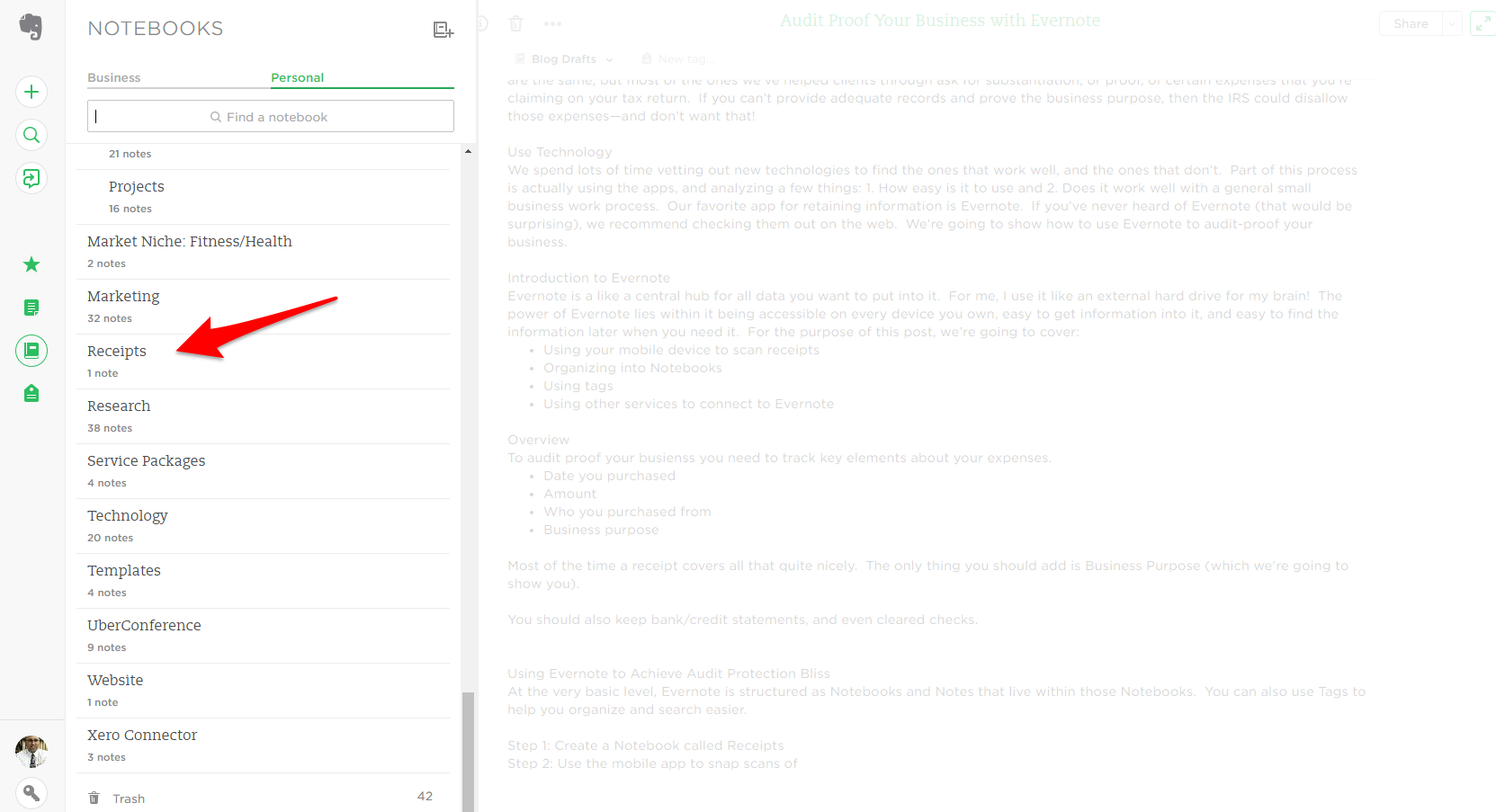

Evernote is a like a central hub for all data you want to put into it. For me, I use it like an external hard drive for my brain! The power of Evernote lies within it being accessible on every device you own, easy to get information into it, and easy to find the information later when you need it. For the purpose of this post, we’re going to cover:

- Using your mobile device to scan receipts

- Organizing into Notebooks

- Using tags

- Using other services to connect to Evernote

Overview

To audit proof your business you need to track key elements about your expenses.

- Date you purchased

- Amount

- Who you purchased from

- Business purpose

Most of the time a receipt covers all that quite nicely. The only thing you should add is Business Purpose (which we’re going to show you). You should also keep bank/credit statements, and even cleared checks.

Using Evernote to Achieve Audit Protection Bliss

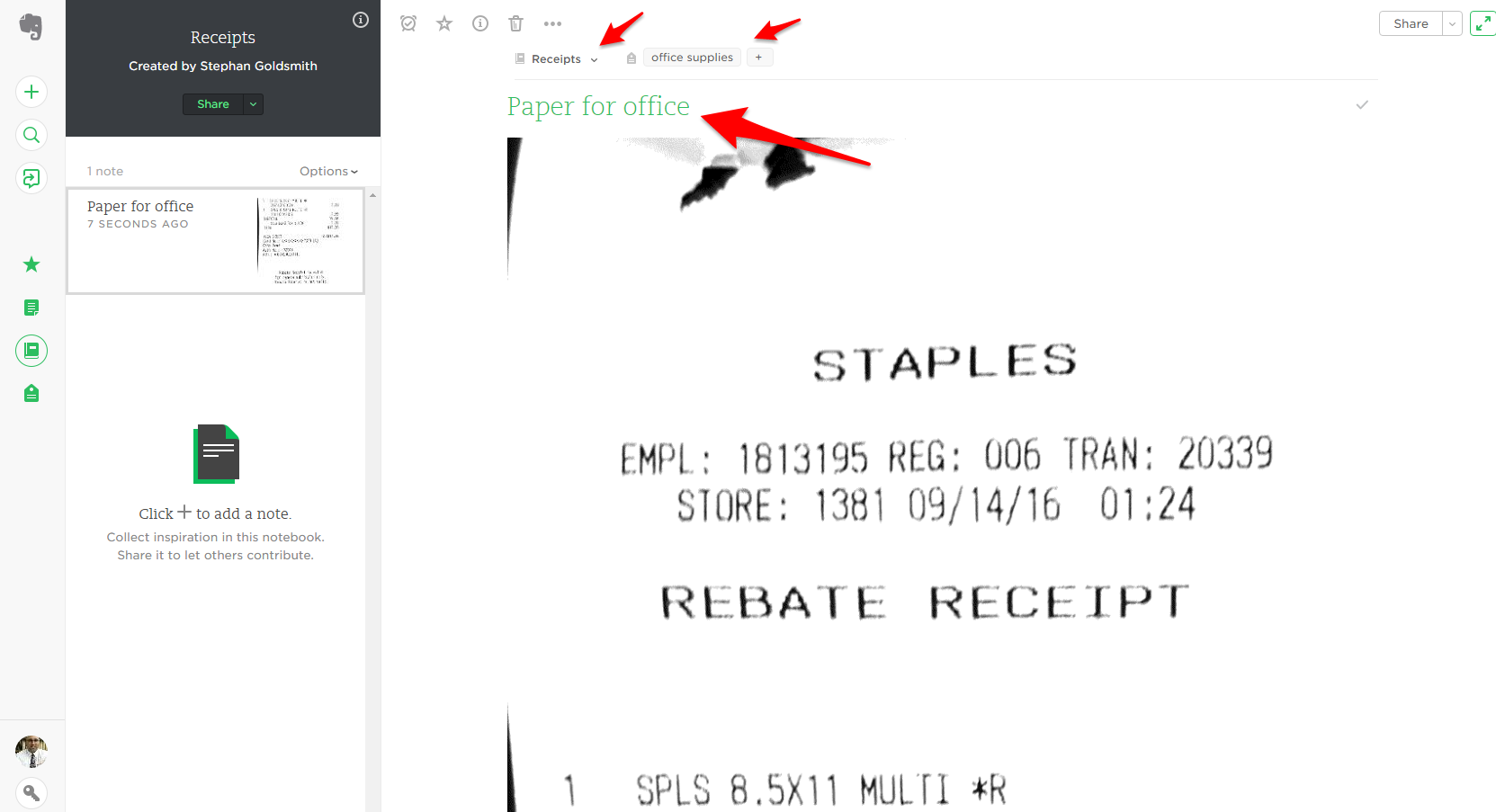

At the very basic level, Evernote is structured as Notebooks and Notes that live within those Notebooks. You can also use Tags to help you organize and search easier.

Keep Receipts

Step 1: Create a Notebook called Receipts

Step 2: Use the mobile app to snap scans of your receipts as you make purchases

Notice that the Notebooks is “Receipts” and we’re using a tag called “office supplies” so that we can easily search for office supplies. Also, you’ll notice we put the business purpose as the name of the note. You can do this on your computer, or on your mobile device.

Step 3: Do the same process for every receipt you get. Evernote will become your repository for all your receipts. You can easily search for your receipts by tag if you want to see all of your Office Supply receipts.

Keep Bank Statements

After using Evernote you’re going to find more useful ways to use it in your everyday life. One key feature is being able to keep and store attachments in notes. Now, downloading your bank statements and putting them in Evernote is not that hard, but it’s also not that convenient. Remember we said that one of the key features to apps we use is convenience?

The solution to this is to use an Evernote Marketplace app called File This. File This is simply an app that will automatically retrieve your bank, credit card, utility statements, and put them where you tell it. While it will export directly to popular cloud-based file sharing apps like Google Drive & Dropbox, you can also connect it to Evernote.

Once you have it File This connected to Evernote, your bank statements will automatically appear in the designated Notebook within Evernote. File This is pretty robust and even has a free version for you to get started on.

Start Scanning!

Scanning your receipts and storing bank statements within Evernote will start you down the path of preparedness if the IRS decides to “knock on your door”. Of course, in order for this system to work you have to be committed and adopt it as a workflow/system you use in your day to day life. We use this system, we have clients using this system, and we can tell you that with a bit of discipline, it works!

Want to learn more about Evernote? I’m an Evernote Certified Consultant so drop us a line and we’ll help you figure which version is best for you, and discuss how you can use it in your business.

Here are some useful links where you can sign up for free trials: